Wireless Readies for Prime Time:

Interoperability Power to Attract Renewed IT Spending

But Big Questions Remain: How

Much? How Soon? With Whom?

By

JOHN

PARKER and STEVE WEISSMAN

The

promise of wireless networking has been with us for a long, long time,

but issues of compatibility, reliability, capacity, and security have conspired

over the years to keep it from reaching critical mass. However, recent

symbiotic advances in connectivity and communications have enabled the

technology to gain practical traction as an enterprise interoperability

(EIO) and accessibility tool, and thus to be viewed as a credible means

for wringing more value from existing IT infrastructures.

|

| This being the case, customers and vendors alike are starting

to ask two fundamental questions whose answers have enormous market-making

potential:

How big will the wireless payoff really be,

and how great is the risk of investing now?

Even though their post-9/11 nerves are still raw and, for many, a lot

of economic red ink is still damp, customers today recognize that they

are not in business for the sole purpose of not spending money: rather,

they know they must start spending smart and acquire technology that will

help them work better, and work better together.

As a result, many economic forecasters Kinetic Information among them

believe the capital investment clock has been reset, and that customers

are ready to resume play (to the tune of spending 3%-5% more this year

than last see our Brief last month Trading

Mayhem for Mainstream). And since wireless is becoming an increasingly

important part of many game plans, vendors of all related ilk software

providers, telecom companies, and personal device manufacturers are starting

to gear up for an opportunity that is as exciting as it is yet uncharted

(see box).

Making the Case for Wireless EIO

That there is a market for EIO at all was proven and validated in Kinetic

Informations seminal work Mapping the Market

for Enterprise Interoperability, which was published in the latter

half of 2002 and predicted a worldwide opportunity for software-related

products and services that will reach $62.7 billion by 2006.

Further research into the space now tells us that a particular EIO hot

spot lies in the realm of wireless and mobile computing. Encompassing the

platforms, applications, and development tools that characterize the market

as a whole, the wireless environment also embraces carrier services and

personal hand-held devices as well, and thereby adds a new dimension of

opportunity to the mix.

|

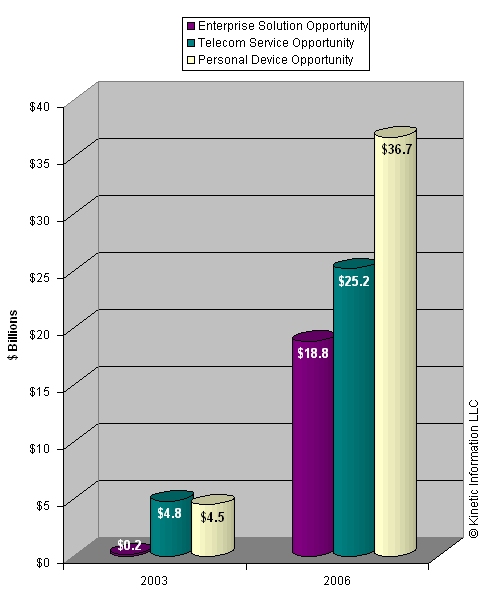

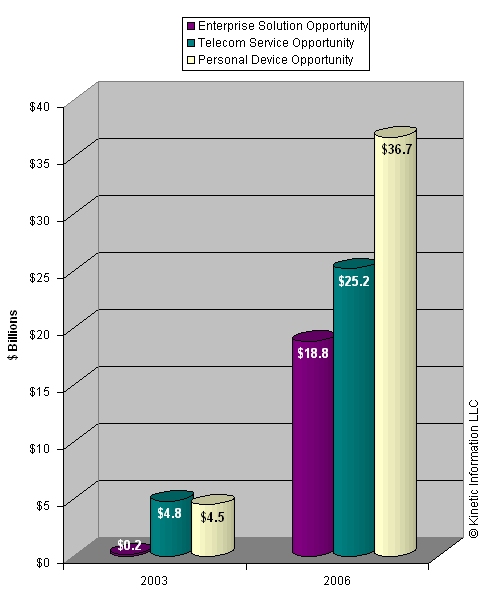

AN $80 BILLION

OPPORTUNITY KNOCKS!

(chart:

est. worldwide opportunity 2006)

For

Enterprise Solution Providers

Extend customers enterprise

infrastructures to embrace, literally, the world

Increase the accessibility

and utilization of business applications

Enable usability via multiple

access devices (cell phone, PDA, tablet PC, etc.)

For

Telecom Carriers

Renew investor interest

and appeal by capturing new opportunity

Generate additional network

traffic leading to higher usage revenue

Offer premium service tiers

tied to speed, bandwidth, data integrity, etc.

For

Personal Device Manufacturers

Sell voice/data/image-capable

devices in multiple form factors

Cross-sell to consumer

and business audiences

Distribute via resellers

of communications and computer technology

|

|

Given the ubiquity of telecommunications in our business

and personal lives, wireless EIO offerings should easily outdistance conventional

PC- and server-based EIO solutions in terms of the revenue they generate

especially if and as effective partnerships are forged between players

on the computing and telecom sides of the business. Here are just a few

of the reasons were so bullish:

Pervasive computing is grabbing mindshare and fueling industry

partnerships. The idea of embedding wireless communication and transaction

processing in small-footprint devices inside appliances, vehicles, and

other non-PC environments has been promoted by IBM and other industry leaders

for nearly a decade. Application development for pervasive computing was

a major motive behind IBMs acquisition of Rational Software late in 2002.

And pervasive computing got more publicity during the latest CES show in

Las Vegas, when Microsofts Bill Gates demonstrated a wristwatch

that was equipped with the companys Smart Personal Object Technology (SPOT)

to deliver a stream of wireless data feeds directly to the user in the

most literal sense.

Smart phones are poised to swamp the market. The ability to combine

multiple functions and the pressure on service providers to make multi-function

packages affordable presages the death of the voice-only cell phone.

According to Allied Business Intelligence, shipments of replacement handsets

will increase from 211 million last year to 591 million in 2008, at which

point they will account for 85% of all shipments worldwide.

Web services are reaching market-ready levels of security and reliability.

This became clear in December 2002 when Microsoft, IBM, BEA Systems, VeriSign,

and RSA Security announced publication of the first set of WS-Security

specifications. Meanwhile, in early January 2003, Sun Microsystems, Oracle,

and Fujitsu announced WS-Reliability specifications that are designed to

facilitate the use of standard interfaces. Continuing progress on security

and reliability fueled by competition will go far to convince business

enterprises to explore the ROI advantages of using Web services, both as

a low-cost method of encapsulating business processes in software

and as a way to rapidly share those processes with a widely distributed

and mobile audience of customers, employees, and partners.

Wireless LANs are becoming widely available. A consortium of technology

leaders including AT&T and Intel Corp. are seizing the opportunity

to create much-needed revenue streams by selling wireless LAN access, based

on the 802.11b protocol, in the U.S. The groups Project Rainbow produced

a new company called Cometa Networks that will sell to ISPs and to cable

and telecom carriers. We expect other similar ventures to appear in the

months ahead.

In the end, we expect the worldwide annual revenue opportunity to

exceed $80 billion by 2006, broken down as follows:

Wireless

EIO Market Opportunity, 2006

Questions

Seeking Answers

Questions

Seeking Answers

All this being so, suppliers of the hardware, software, and services

needed to make wireless EIO a reality already are jockeying to see who

will be first out of the gate to tap the new opportunities. Succeeding,

of course, requires a thorough understanding of the perils and possibilities

that will appear along the way and effective answers to a host of critical

questions such as these:

Is it realistic to expect as many in the media, vendor, and analyst communities

do that wireless networking and EIO will be high-octane fuels for the

economic recovery? If not, then are we again putting too much emphasis

on unmarketable technology?

Assuming the opportunity is real, then what is its nature? What applications

are likely to be used by people in their work AND in personal lives, often

from the same device/platform and sometimes at nearly the same time?

What is the potential monetary payoff for technology vendors providing

the hardware and software needed to make mainstream use a reality?

What are the economic, business process, and communications/collaboration

payoffs for users seeking Maximum Total Value from their wireless technology

investments?

What functional and technical characteristics network reliability and

availability, application development, security, pull features to engage

end users, etc. are necessary for wireless networking to reach the next

level?

What type(s) of technology, service, and support are essential to ensuring

implementation success? What will the interplay be among them?

Which vendors are leading the pack in terms of innovation?

How do such major players as HP, IBM, Microsoft, and Sun see the wireless

networking market evolving, and what role are they likely to play in its

emergence and success? What opportunities exist to partner with them and/or

run around them?

What opportunities do telecom carriers, smart phone manufacturers, and

other personal device providers see in wireless networking, and what are

they doing to capture their fair share?

What ingredients are needed to make a IT/telecom partnership work? How

should these ingredients be offered and priced?

At this early stage in the markets development, few definitive

answers to these questions seem to yet exist, though there is a consensus

that opportunity is indeed brewing where wireless and interoperability

are coming together as one observer put it, Well, youre shooting at

the right elephant! As a result, one of our next steps likely will be

to assess the opportunity for ourselves and for our clients, and to provide

some truly workable intelligence to help people realize the untapped potential

we intuitively know is there. Please let us know what you think, too, and well be sure to fill you in as we learn more. Stay

tuned! Contact

Us for More |

Kinetic

Information Home

Kinetic

Information Home